Market making is a bit of a technical business. But at its simplest, the job is to ensure there’s always depth on both the buy and sell side of an order book. When someone wants to trade, they should be able to do it in size, with minimal slippage. The tighter the spread, the better.

Good market making means deep liquidity, solid order books, and prices that update in real time as new information comes in. That’s where technology comes in. Market makers are constantly recalculating fair value, volatility, and inventory. Every second, thousands of adjustments happen across multiple order books. Without serious infrastructure, you can’t do this well, or safely.

Traditional finance has had this figured out for decades. Order books exist to make price discovery as smooth as possible. Market makers step in to ensure someone is always on the other side of a trade, taking on risk in exchange for a tiny cut of the spread.

DeFi and the Rise of AMMs

Then along came DeFi. The whole point of decentralised finance is to remove reliance on centralised entities, exchanges included. Why trust an exchange to hold your funds when you can trade directly on-chain?

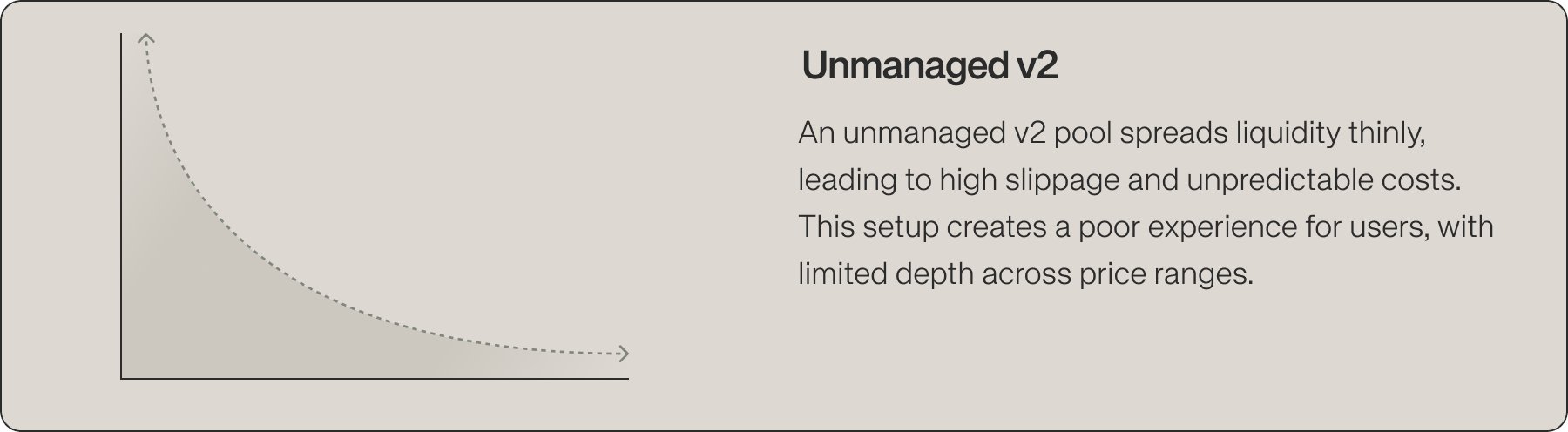

Enter AMMs (automated market makers). Instead of an order book, you’ve got liquidity pools, where users deposit two assets, and asset pricing is derived from a simple constant produce relationship (x * y = k). That’s what made Uniswap V2 work. Liquidity providers earned fees for putting balances into a pool, traders could swap assets without intermediaries, and the whole thing ran autonomously on smart contracts.

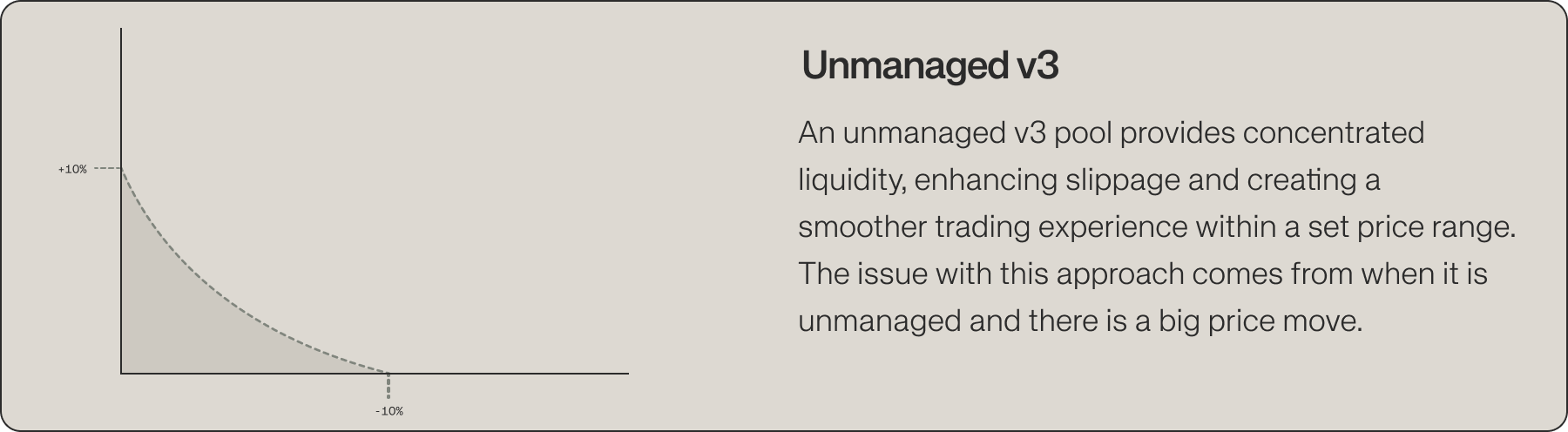

V3 enhanced this innovation with the advent of concentrated liquidity, allowing LP’s to be more efficient when contributing their assets to the pool.

Uniswap V4 and Custom Hooks

Uniswap V4 takes things a step further with custom hooks. These give developers more control over what happens during a swap, adjusting fees dynamically, adding or removing liquidity mid-trade, and more.

For example, hooks can introduce dynamic fees that adjust based on market conditions, helping pools stay competitive during volatile periods. They can enable on-chain limit orders, letting traders set buy or sell conditions without relying on centralized exchanges. Hooks can also be used for liquidity rebalancing, where liquidity shifts between pools to improve efficiency, or yield optimisation, automatically deploying idle liquidity into lending protocols when trading activity is low.

It’s a powerful innovation, and we’ve already seen interest from clients who we helped quickly migrated to v4 upon launch.

If AMMs Work, Why Do We Still Need Market Makers?

AMMs solved one problem, removing centralised exchanges, but they created others. Traditional order books are incredibly efficient at price discovery. They usually work on price-time priority: best price gets priority, and the first in line gets the fill. That’s been refined over decades because it works. Early AMMs were nowhere near as efficient.

Even with Uniswap V3 and V4, AMMs haven’t fully caught up. They’re powerful, but it doesn’t change the fundamentals. You still need liquidity. You still need price discovery. And there will still be times when market makers step in to smooth things out. The reality is, most institutional and high-frequency traders also still prefer order books. Even if we had fully on-chain order books at the speed of centralised (which we’re getting closer to), you’d still need someone providing liquidity at all times. Otherwise, you’re just waiting for someone to take the other side of your trade. That’s why market makers aren’t going anywhere.