The memecoin meta grew and grew last year, and reached frothy new heights this week with the arrival of $TRUMP and $MELANIA. These new somewhat controversial new entrants have brought fresh volatility and a flood of inexperienced retail investors into the crypto markets. As market makers, these dynamics present a double-edged sword of risk and opportunity.

$TRUMP and $MELANIA

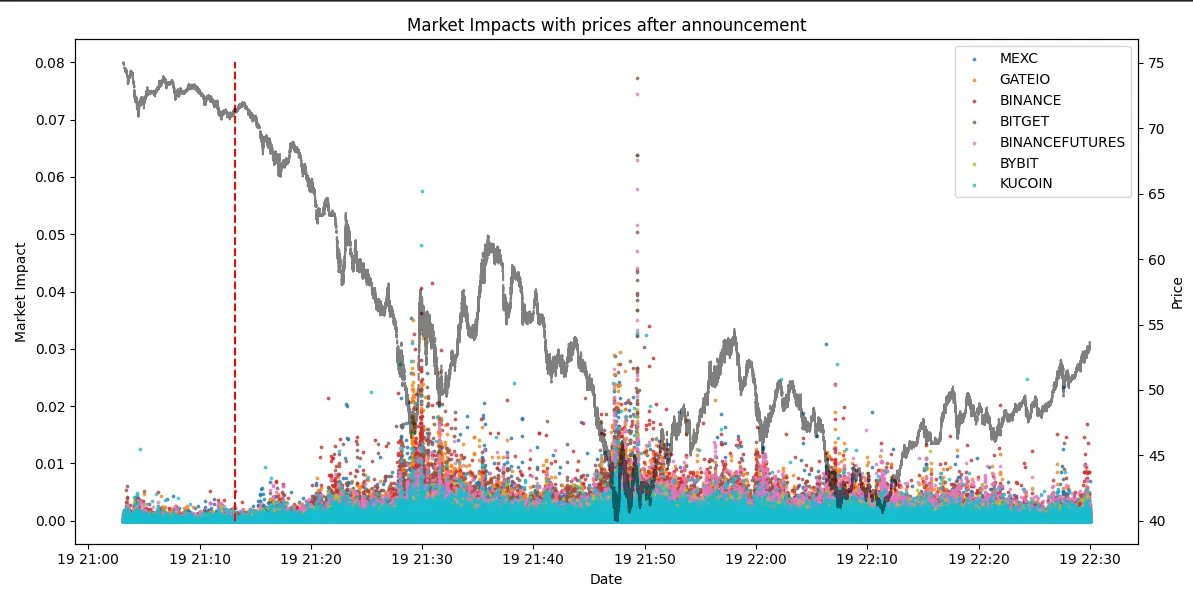

$TRUMP and $MELANIA aren’t just memecoins; they’re tokens wrapped in political spectacle, emblems of a brave new world in which we we find ourselves. As you would expect, both have shown the classic hallmarks of memecoins: extreme volatility, thin liquidity, and a community-driven narrative. Sentiment and speculation drive the market, and for market makers, that means navigating a minefield where the market can shift instantly.

Why Memecoins Are Different

Retail-heavy markets like $TRUMP and $MELANIA amplify volatility in ways other tokens don’t. Thin liquidity + wide spreads mean order books are easily overwhelmed when volumes spike. FOMO can cause a viral tweet to skyrocket a token’s price, only for it to nosedive when the hype dissipates. Inexperienced traders panic-sell at dips, creating cascading sell-offs. for market makers, this is the crypto volatility we all know but amplified by several orders of magnitude.

Real-time risk management is essential, with the ability to adapt to volatile conditions in seconds, not hours. Transparency under scrutiny is crucial, especially for high profile projects where order books are watched closely, and any perceived manipulation erodes trust.

Ethical Liquidity

Memecoins are the ultimate stress test for market makers. They show why ethical liquidity provision is so critical. Retail traders need stability, and that’s where market makers come in. At LO:TECH, we prioritise fair price discovery and market stability, not engineered pumps. Transparency is at the core of what we do, ensuring our partners and their communities understand how liquidity is managed. We also adapt to the chaos of memecoins, recognising their differences from utility tokens and implementing strategies that work for their unique profiles.