The State of Crypto

Market Making —2025

A practical guide for founders navigating the risks, mechanics, and decisions that shape crypto market making.

Why This Report Exists.

Market making remains a critical but often misunderstood component of token success. Despite its importance, many projects enter liquidity partnerships with limited visibility into how these relationships are structured, how market makers actually operate, and potential long-term implications.

This independent report draws on the views of over 2,000 crypto community members across 98 countries, alongside conversations with founders, investors, and industry experts.

It maps out the mechanics, incentives, and behaviours shaping token liquidity in 2025, and highlights the points where structural risks are often introduced.

WHAT PEOPLE ARE SAYING...

“Navigating the market making landscape as a founder often means making high-stakes decisions with limited information. This report is one of the few resources that actually helps reduce that asymmetry. It’s a valuable read for anyone trying to get smart fast.”

“Crypto market making's opacity has left investors in the dark for too long. This report delivers an essential, data-driven deep dive, finally illuminating practices and empowering the market with actionable clarity.”

“In a space drowning in noise, this report actually says something new. It’s clear, grounded in first-principles reasoning, and essential reading for anyone serious about market structure – especially founders trying to understand how crypto market making works, how it can fail, and what matters most.”

“The State of Crypto Market Making Report is a must read for every VC, Founder and serious trader looking to understand the good, bad and ugly of crypto market making. Many of the report's recommendations, including tranche'd structures and performance dashboards, can drive additional accountability and performance.”

Key Topics Covered

WHAT MARKET MAKERS ACTUALLY DO

The role of market makers and how they operate behind the scenes

DEAL STRUCTURES EXPLAINED

The two most common deal models:

Retainer vs. Option + Loan

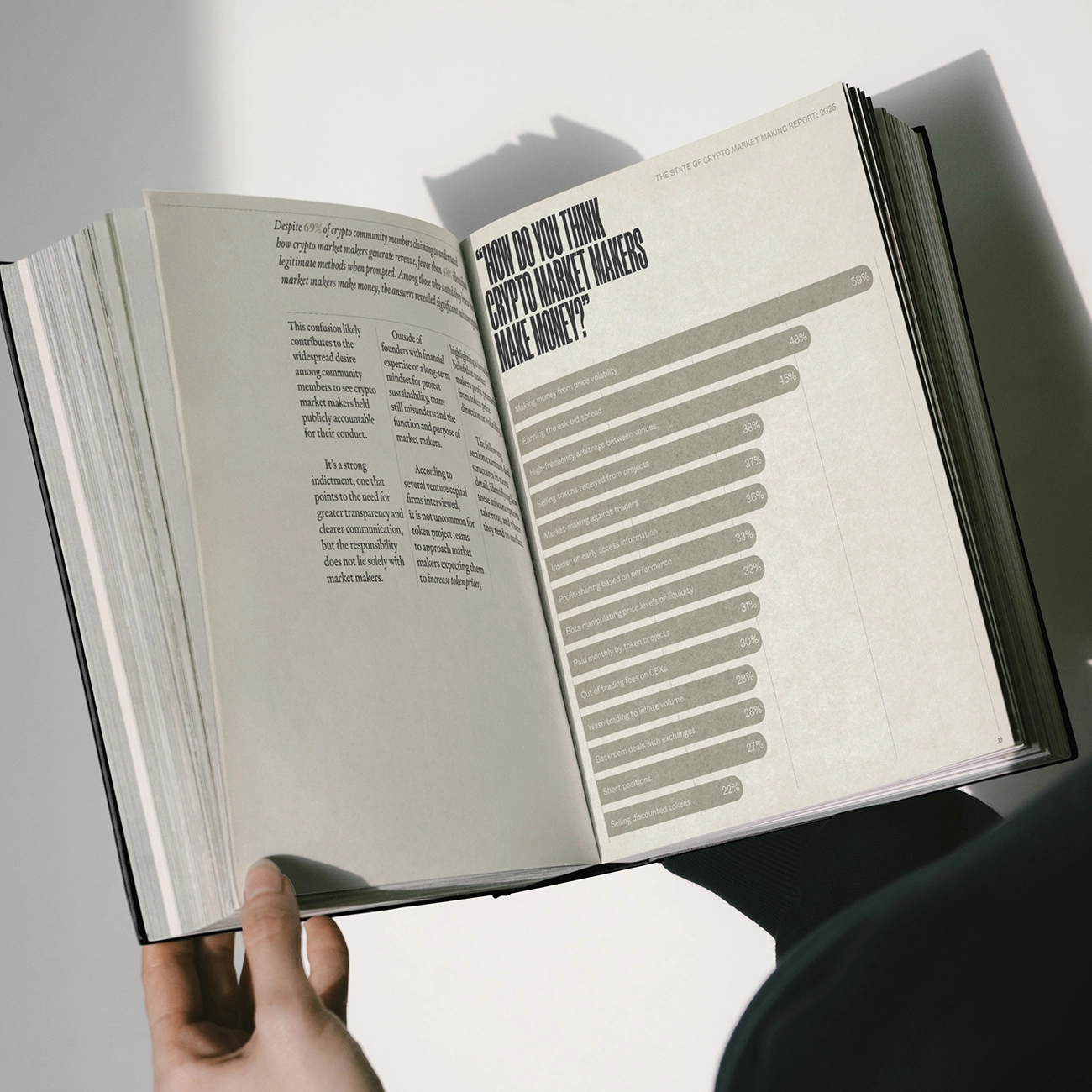

HOW MARKET MAKERS MAKE MONEY

How token loans, spread capture, and hedging affect market behaviour

RISKS HIDDEN IN PLAIN SIGHT

The risks of misaligned incentives, wash trading, and performance opacity

DEFINING ‘GOOD’ LIQUIDITY

What good liquidity actually looks like, and how to measure it

ASSESSING MARKET MAKERS

A framework for evaluating partners, structuring terms, and building visibility

HAVE A PEEK INSIDE...

2,000 VOICES FROM 98 COUNTRIES

Findings from a global survey of the crypto community, capturing perspectives on transparency, control, and the role of market makers in token performance.

37% SEE MARKET MAKERS AS PRICE MANIPULATORS

Survey results reveal deep divisions in how the crypto community views market makers, from accusations of manipulation to recognition of their role in keeping markets liquid.

FROM TRADING FLOORS TO CRYPTO LIQUIDITY

A look at how market making evolved from the Amsterdam Exchange Courtyard in the 1600s to today’s digital asset markets, and why the core principles remain the same.

HOW MARKET MAKING WORKS ON CEXs

The traditional model of market making, operating on centralised order books, placing two-sided quotes, and managing risk to ensure liquidity on venues like Binance, OKX, and Coinbase.

THE TWO DOMINANT DEAL STRUCTURES

A breakdown of the most common agreements between token projects and market makers, and how each model impacts incentives, flexibility, and long-term liquidity.

Download the Full Report

This free guide is designed for founders, project teams, and investors navigating the complexity of token liquidity in 2025.

Access the full comprehensive report, including frameworks, community data, and practical insight into effective market making.

(Free Download)